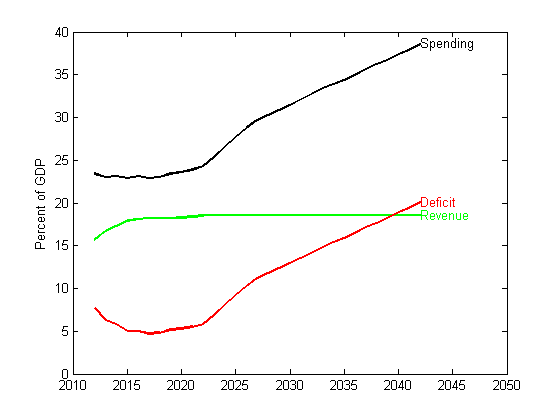

If we don’t change the path we’re on, the CBO says this is what our financial future looks like:

The chart comes from one of my new

favorite blogs. It’s called “The Grumpy Economist,” the grumpy one

in question being John Cochran, a professor at the University of

Chicago Booth

School of Business, a senior fellow of the Hoover Institution, and an adjunct scholar of

the Cato Institute.

He claims that he is not actually grumpy, but regardless, his blog posts

are always worth reading. Here is what he writes about this chart:

Above,

I plot the CBO’s long term outlook, in the alternative fiscal scenario (i.e.

the one that is even faintly plausible). As you can see, though they

think the deficit gets better for a bit, then the entitlements disaster is

still with us.Of course, this will not happen, the only question is what adjusts.

If bond markets get a whiff that we actually will try these paths, we have a

crisis on our hands.So what can adjust? Revenue is historically about 20% of

GDP no matter what tax rates are. Doubling Federal revenue, while of

course states, cities and counties keep taxing us, seems like an unlikely

prospect. I’m all for cutting spending, but really, cutting spending in half,

and by more than 20 percentage points of GDP? Well, it’s in the Ryan budget,

but it’s a lot.

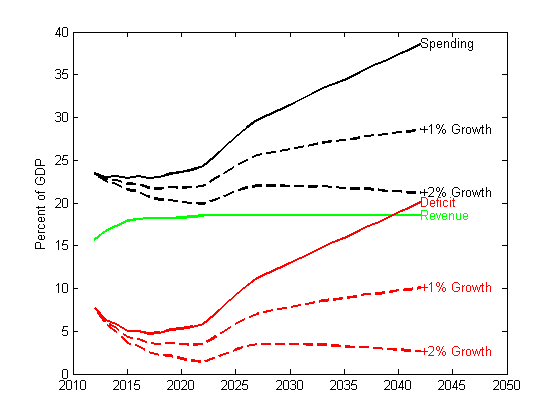

So,

what else can we do? Answer: Growth. Tax revenue equals tax rate times income,

and income equals todays income times growth. Greater growth makes all the

difference.

He then takes the CBO’s numbers, and

calculates what they would look like if growth were one percentage point or two

percentage points higher than projected:

The historical average for revenue

collection as a share of GDP has been under 20 percent. Additionally,

economists have shown that, starting at a certain level, government spending

and debt hurt economic growth. This makes achieving high growth without

shrinking the size of government much harder to achieve than one may think.

But further, to make matters worse, the

CBO’s growth numbers are unrealistically optimistic in the first place. If you

really want to scare yourself, go read the rest of Cochrane’s

post and look at what our debt and deficit levels would look like if we

don’t grow as much as the CBO projects.

No comments:

Post a Comment